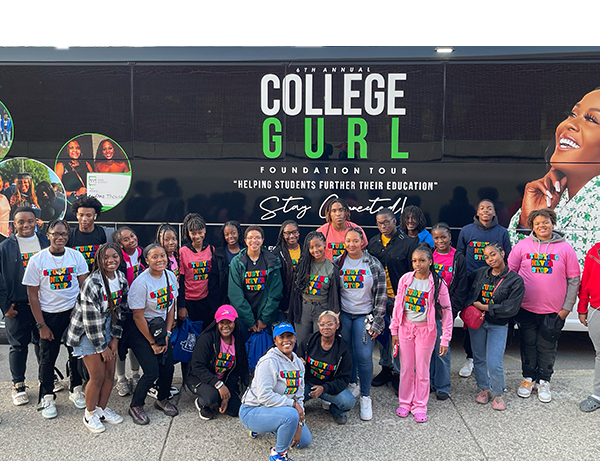

Hey! It’s College Gurl!

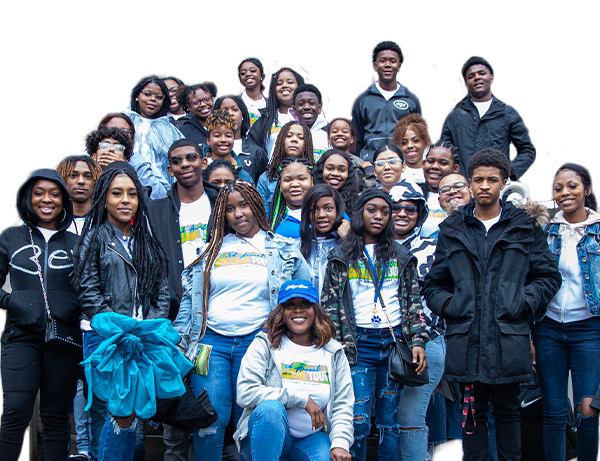

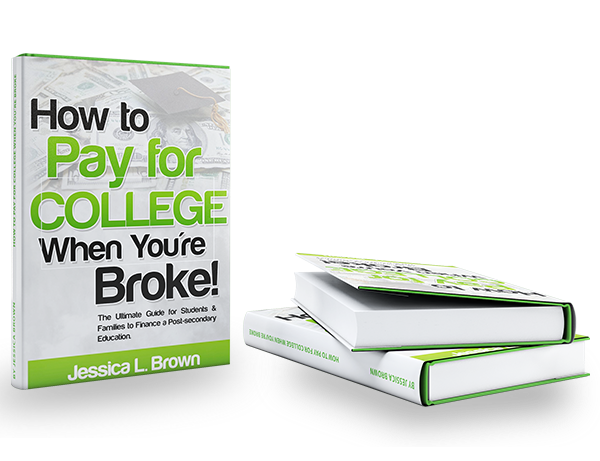

Crowned the Financial Aid Fairy Godmother, College Gurl has the magic to prepare you for college and professional success! College Gurl is committed to educating the nation on realistic strategies for paying for college and creating the next future leaders of tomorrow. Through College Gurl and the non-profit The College Gurl Foundation, thousands of students and their families have been supported, millions of dollars in scholarships secured, and job opportunities have been granted.